The first step in preparing an income statement is to choose the reporting period your report will cover. Businesses typically choose to report their P&L on an annual, quarterly, or monthly basis. Publicly traded companies are required to prepare financial statements on a quarterly and yearly basis, but small businesses aren’t as heavily regulated in their reporting. For small businesses with few income streams, you might generate single-step income statements on a regular basis and a multi-step income statement annually.

- Save more by mixing and matching the bookkeeping, tax, and consultation services you need.

- This helps the company set prices and see how well they’re doing financially.

- Single-step income statement – the single step statement only shows one category of income and one category of expenses.

- Set your business up for success with our free small business tax calculator.

- Implement our API within your platform to provide your clients with accounting services.

- These take minimal time to prepare and don’t differentiate operating versus non-operating costs.

Losses as Expenses

This helps the company set prices and see how well they’re doing financially. It’s a way to keep track of all the costs and make sure the business can make money. The lemons and sugar cost $30, and paying a friend to help cost $10. Then, imagine the stand also had to pay $20 for a stand permit as an expense. So, you subtract $20 from the gross profit, leaving a net income of $40.

What kinds of businesses use traditional income statements?

This can be done with accounting software, like QuickBooks Online. You can also look at QuickBooks Online subscription levels and see a comparison of QuickBooks vs. Xero accounting software. Net income—or loss—is what is left over after all revenues and expenses have been accounted for. If there is a positive sum (revenue was greater than expenses), it’s referred to as net income.

Company B Income Statement

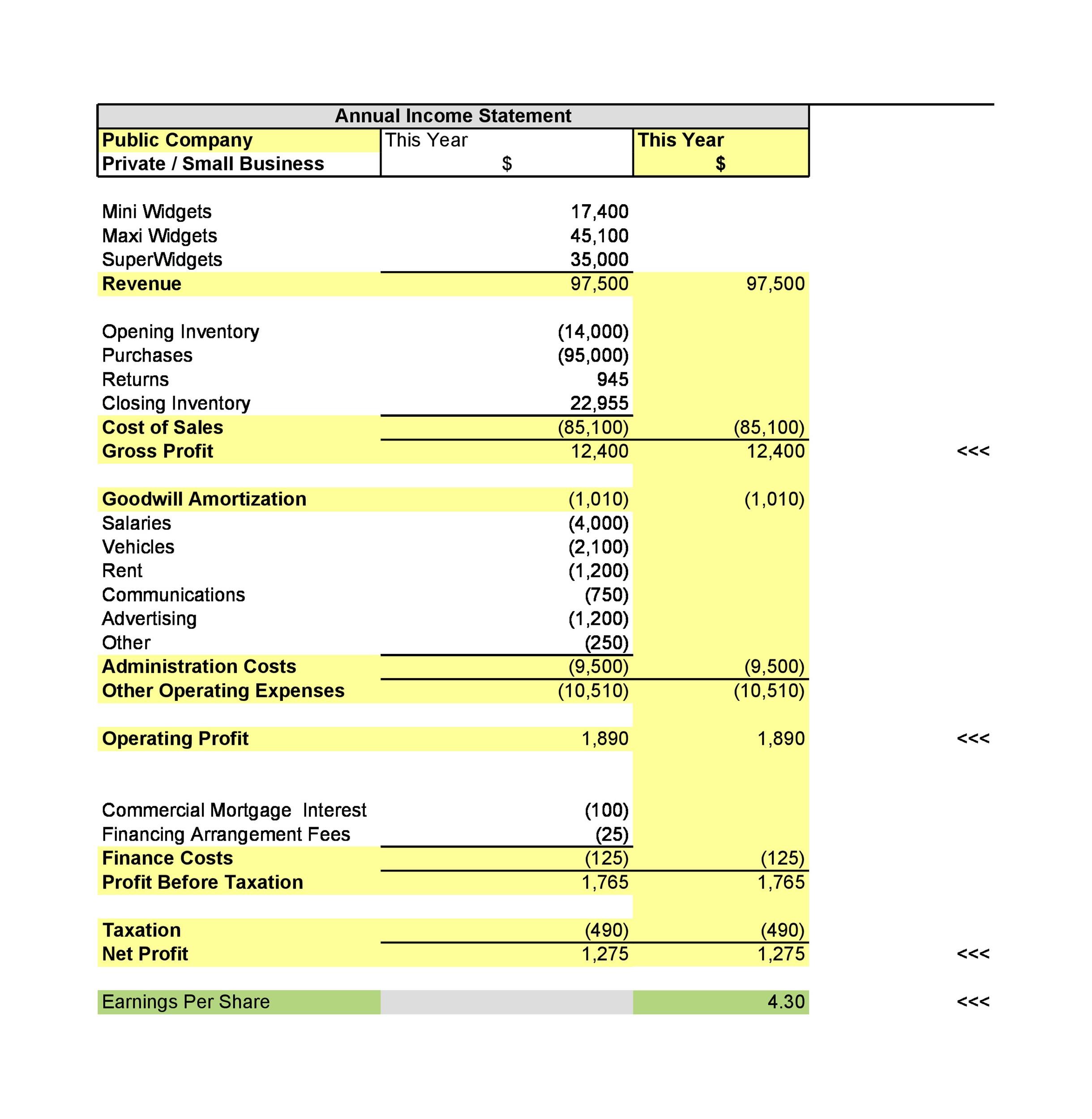

Then, we incorporate other revenues and expenses to come up with the income to be subjected to tax. First, the gross profit is computed by deducting cost of sales from sales. Operating expenses include selling expenses and administrative expenses.

You can connect with a licensed CPA or EA who can file your business tax returns. Set your business up for success with our free small business tax calculator. Save more by mixing and matching the bookkeeping, tax, and consultation services you need. Dear auto-entrepreneurs, yes, you too have accounting obligations (albeit lighter!). Accounting books, annual accounts, compulsory chartered accountants…

With insights from all three of these financial reports, you can make informed decisions about how best to grow your business. Last but not least, calculate the operating income by subtracting selling and best xero add administrative expenses from gross profit. Once you have the cost per unit, the rest of the statement is fairly easy to complete. All variable items are calculated based on the number of units sold.

Internally, they can be used by company executives or management teams. If you subtract all the outgoings from the money the company received, you are left with $21,350. The company also realized net gains of $2,000 from the sale of an old van, and incurred losses worth $800 for settling a dispute raised by a consumer. For example, a customer may take goods/services from a company on Sept. 28, which will lead to the revenue accounted for in September. The customer may be given a 30-day payment window due to his excellent credit and reputation, allowing until Oct. 28 to make the payment, which is when the receipts are accounted for.

Using the cost per unit that we calculated previously, we can calculate the cost of goods sold by multiplying the cost per unit by the number of units sold. Let’s use the example from the absorption and variable costing post to create this income statement. Let’s use a fictional company, “Moonlight Bookstore Inc.”, to illustrate a traditional income statement. HBS Online’s CORe and CLIMB programs require the completion of a brief application.